Introduction

On 1 December 2025, the Nigerian Upstream Regulatory Commission (NUPRC) commenced the process for the 2025 Nigeria licensing round. In this round, the NUPRC has listed 50 (fifty) Petroleum Prospecting Licenses as being on offer.

The purpose of this practical guide is to provide a general context to the Licensing Round, highlighting our view of best practices to a successful bid.

The legal framework for this round is provided under the Petroleum Industry Act 2021 (PIA)—which governs bids for petroleum leases and licenses—and the Petroleum Licensing Round Regulations. In addition, the NUPRC has issued the Nigeria 2025 Licensing Round Guidelines pursuant to the PIA.

Nature of Assets in this Round

This round has generated interest among industry participants as it features a mix of blocks across onshore, shallow‑water, inland, and offshore/deep‑water terrains. The NUPRC has stated that the 2025 exercise will focus on discovered and undeveloped fields, fallow assets, and prioritize natural gas development to support Nigeria’s commitment to the UN Sustainable Development Goals. As noted above the list of PPLs on offer are available to investors.

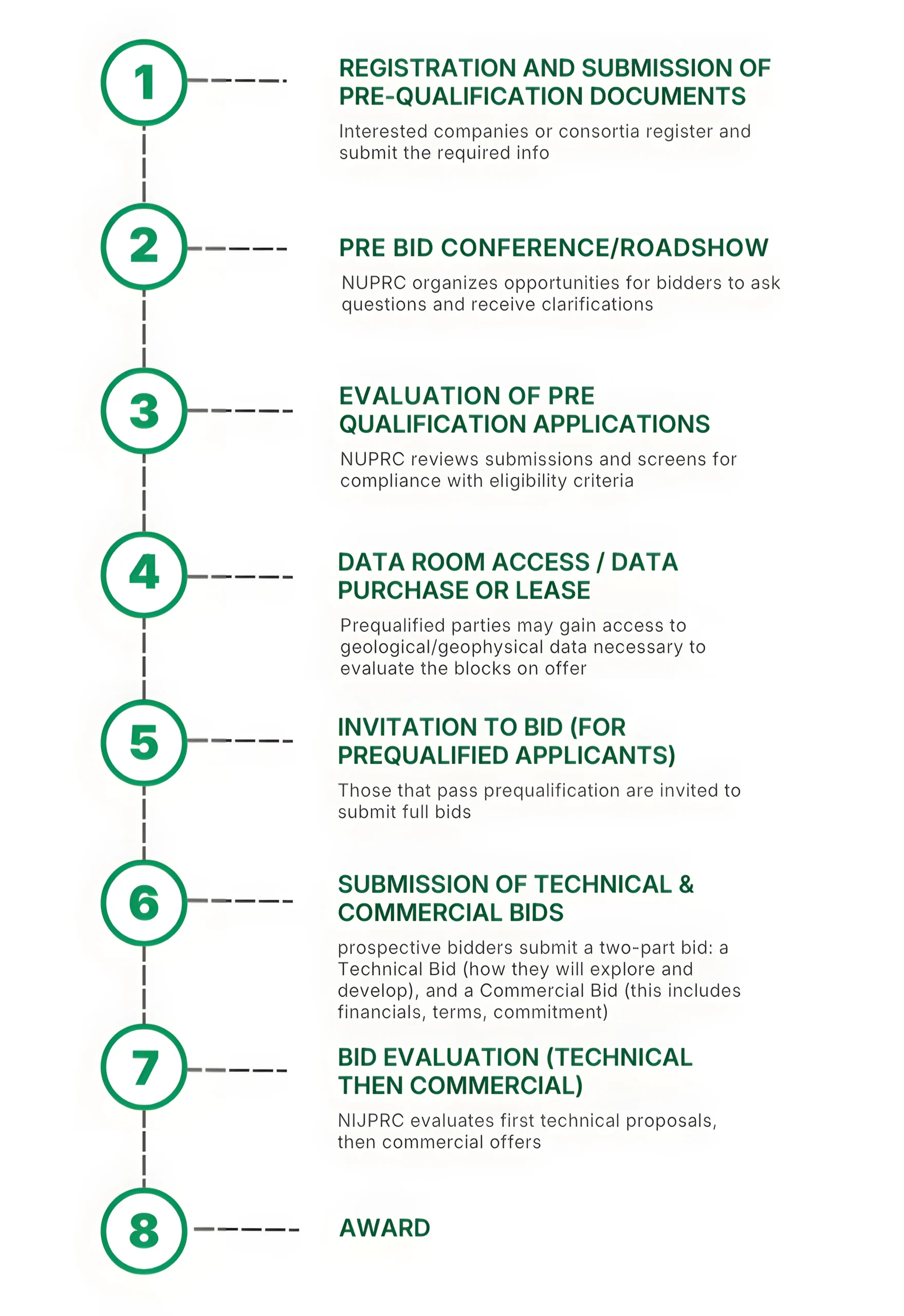

Process & Timeline

Registration & Pre-Qualification

The NUPRC has made the formal announcement and launched the portal. The 2025 Nigeria Licensing Round follows a structured two-stage process: pre-qualification and bid submission. To begin, a bidder must register and undertake the pre-qualification process. Upon pre-qualification, the bidder will be granted data room access to geological and other relevant data for the PPLs.

Bid Submission

Pre-qualified applicants must submit the following:

- A Technical Bid – which details exploration and development plans.

- A Commercial Bid – financial proposal including bid fees, work programme budgets, and proposed terms.

- Bid Guarantee – security demonstrating ability to meet obligations.

All documents must be physically sent to NUPRC. However, the Commercial Bid must also be uploaded to the licensing portal by the deadline of 4:30 PM on 27 February 2026.

Bid Evaluation

NUPRC will assess technical bids, particularly focusing on operational plans, work programme feasibility, and compliance.

It then undertakes a commercial evaluation for financial terms and overall attractiveness of the bid.

Award and Contracting

- Successful bidders are granted Petroleum Prospecting Leases (PPLs).

- Ministerial approval is required before execution of contracts.

- Estimated timeline for award: 20 July 2026 – 16 October 2026

The flow chart below expresses each step required of participants in the process:

Eligibility & Participation

The NUPRC’s core criteria for bidders are technical capability, financial strength and corporate compliance. It requires a successful bidder to demonstrate the ability to develop and ultimately commercialise the fields within the license area. This requirement is easily met by existing operators of oil and gas assets in Nigeria or elsewhere. New industry entrants improve their chances by associating with technical partners. Our experience in the industry has shown that in such associations, the parties must properly document their intentions, plans and mechanisms to achieve set objectives.

The requirement to show financial strength is often related to the capability to demonstrate the ability to raise acquisition finance and also to show a track record that demonstrates to the NUPRC that the bidder can successfully execute a development work program.

Pre-Qualification Requirements

| Criteria | Details |

| Incorporation Status | – The company must be incorporated in Nigeria on or before the submission deadline, i.e., 27 February 2026. – Foreign companies may participate but must incorporate a Nigerian entity before the award of PPL. |

| Consortium Participation | – Companies can apply individually or as part of a consortium. – Consortium members should clearly define roles, responsibilities, and shareholding. – All members must meet pre-qualification requirements individually. |

| Number of Blocks | – Each company or consortium may submit bids for up to two blocks. – Separate applications and fees are required for each block. |

| Mandatory Fees | – Payment of bid fees for each block is required. – Any data purchase or lease fees must also be fully paid by the application submission date. |

| Key Assessment Areas | – Technical & Operational Capability: Experience in exploration, development, and production operations. – Financial Capacity: Ability to fund the work programme and fulfil financial obligations. – Compliance with Laws & Standards: Including HSE, environmental, transparency, and beneficial ownership disclosure. |

After evaluation of applications, the NUPRC will notify short-listed qualified applicants who will be eligible for participation in the bid.

Considerations in Making Your Bid

- Compliance: It is important to follow the timelines set by the NUPRC. The Guidelines provide for a pre‑bid conference. Attending it gives the chance to raise questions, clarify ambiguities, and better structure your bid.

- Strategic Planning: Plan with a focus on corporate structure viability, technical capability and financial strength. This requires putting together a team and may well require collaborations with other companies. Some previous bidders have had success with working with marginal field operators who have produced crude in decent commercial quantities. Some bids also associate with trading companies to assist with initial acquisition funding.

- Financial Planning: The acquisition costs and development costs associated with acquiring an asset and executing a work program are significant. For example, a signature bonus is payable after a bidder is selected for award. The signature bonus for this round is set to be from $3m to $7m. Bidders need raise a mix of equity and debt to fund the acquisition and ensure that there are sufficient funds to meet immediate work program requirements. There are several financing options that can be utilised including corporate financing and in appropriate cases, reserve-based lending options.

Please reach out to us for any questions you have or clarifications you may require.